- “Buy local” movements often gain traction during times of economic hardship in a bid to support small, independent businesses.

- A recent poll revealed that 42% of Canadians were willing to “absolutely do everything” to avoid purchasing US-made products following 25% tariffs.

- As green coffee prices continue to climb, many roasters are raising their retail prices to protect margins, potentially pushing consumers towards their favourite local brands.

- Conversely, a recent US study revealed that private brand sales have increased by nearly a quarter each year over the past four years, reaching a record high in 2024.

- Coffee consumers could either double down on independent roasters or switch to more cost-effective options from regional, national, and international brands.

High green coffee prices have become a new normal for the coffee industry – and they’re reshaping consumer behaviour.

Many roasters have raised their menu prices to manage tight margins, passing additional expenses onto already cost-conscious customers. Some may pivot to more affordable blends or single origins in response, while still staying loyal to their favourite local independent roasters.

Despite a cost-of-living crisis, GlobalData reports that 41% of consumers “somewhat agree” that supporting the local community was more important than buying from larger multinational brands, while 22% “strongly agreed”.

But at the same time, private label products have never been more popular in countries like the US, signalling a division in the market.

I spoke with John Steel of Cafédirect and Alicia Love of Coffee Labs Roasters to find out how rising retail prices could reshape coffee consumer behaviour.

You may also like our article on how rising prices allow consumers to learn more about coffee shops.

How rising coffee prices are reshaping the industry

The C price continues to remain high and volatile. In February 2025, arabica futures rose to an all-time high of US$4.41/lb. Since then, prices have fluctuated, but largely remained above the US$3/lb mark.

Although specialty coffee operates outside the C market, with roasters and importers paying premiums for higher-quality lots, it is heavily influenced by broader market movements.

“Coffee prices have risen so sharply that it’s not just low-cost supermarket coffees that are impacted,” says John Steel, the CEO of B corp UK roaster and coffee retailer Cafédirect. “Those of us who pay more for coffee are particularly affected. When you already pay above the market price for coffee, any global spike on top of that can be difficult to absorb.”

Roasters are also grappling with higher operational costs. Energy prices remain volatile, labour costs are increasing as businesses compete for skilled staff, and sustainable packaging materials often carry a premium price tag. Even borrowing costs are climbing, with higher interest rates making loans and credit facilities more expensive.

All of these conditions put roasters in a difficult position, forcing them to absorb additional costs or pass them on to customers.

In many cases, they have little choice but to raise their retail prices. Already operating on razor-thin margins, absorbing costs in such a challenging economic landscape is too risky for most roasters.

But despite price increases, consumers keep drinking coffee – and more of them want higher quality options. The National Coffee Association’s latest NCDT report found that the number of US citizens drinking specialty coffee in the past day has increased dramatically between 2020 and 2025. For every 100 cups of coffee consumed, 59 are specialty and 41 are traditional, representing an 18% increase over the five-year period.

“After two recessions in 22 years, people still need their coffee – in shops and online, too,” says Alicia Love, the president and owner of Coffee Labs Roasters in New York, US. “Younger consumers have had specialty coffee shops around them their whole life, and many think nothing of buying a high-end, premium drink.

“We also saw a shift to espresso-based drinks during Covid-19, which make up the bulk of our over-the-counter sales,” she adds.

How are coffee consumers responding?

Even in the wake of high prices, consumers are maintaining their levels of coffee consumption.

“Coffee remains one of life’s small daily rituals – something people are reluctant to give up,” John says. “But the way they drink it, and the choices they make, are changing.

“The cost-of-living crisis has made many people more conscious about where their money goes,” he adds. “We’re seeing a rise in home coffee ’nooks’, with more people investing in bean-to-cup machines, trying out different beans, and exploring milk alternatives.”

But while people are still willing to invest in high-quality coffee options, rising prices will inevitably shift consumer behaviour.

According to a UN FAO report from March 2025, it will take almost a year for consumers to feel the effects of price spikes. The report states that up to 80% of these price rises will take up to 11 months to trickle down to EU consumers – and to US consumers in just eight months. The residual effects of these price rises are expected to last for four years.

“I think we’ll see the real change of rising coffee prices in the third or fourth quarters of the year,” Alicia says.

Brands like JM Smucker, which owns Folgers, Dunkin’ at Home, and Café Bustelo, are warning of further retail coffee price increases in August, following earlier hikes in May, June, and October last year.

Some supermarkets and grocery retailers have pushed back, signalling that prices are reaching the limits of what consumers will tolerate. JDE Peet’s also faced backlash from European retailers for its price hikes, with some chains even refusing to stock its products during negotiations.

As major brands pass on costs to maintain their margins, we can expect to see a widespread shift in consumer behaviour.

Following trends in other markets that have experienced similar price shocks, consumers initially absorb increases. However, as prices remain high or continue to rise, they inevitably adjust their behaviour to cope with the elevated costs.

Eggs in the US market are a prime example. Average prices for a carton of eggs have soared from US$1.49 in 2018 to US$5.18 in 2025. In response, over a third of US consumers said they have stopped buying eggs, and won’t begin to purchase them again until the price comes down to US$5 or less.

Changing coffee consumer behaviour could include buying less of the brands they typically purchase, switching to cheaper alternatives or private label products, or stopping the purchase of these goods altogether.

A recent US study shows that over the past four years, annual private brand sales rose by nearly a quarter, reaching a record high in 2024. In the context of the coffee industry, this indicates that more consumers are shifting from premium beans to cost-effective supermarket blends – a sign of growing dependence on larger multinational brands.

Could the “buy local” movement proliferate in specialty coffee?

To offset steadily increasing prices, more customers are likely to pivot to cost-effective coffees, including more blends and affordable single origins like Brazil and Vietnam.

This switch, however, doesn’t always equate to a move towards bigger brands.

“Buy local” movements often gain traction during times of economic hardship in a bid to support small, independent businesses. Following the rollout of 25% US tariffs, 42% of Canadians were willing to “absolutely do everything” to avoid purchasing US-made products, determined to invest in local and national brands as a sign of solidarity.

As roasters continue to grapple with rising prices and operating costs, consumers could stay loyal to smaller, local brands, building a sense of rapport and connection with businesses that depend on their continued support.

“People may start to think more carefully about where their money goes, and choose to spend it with local businesses rather than multinationals like Starbucks,” John says. “There’s growing interest in value, not just in terms of taste or convenience, but in the bigger picture: where does this coffee come from, and who benefits when I buy it?”

Effective long-term strategies for roasters

As consumer behaviour shifts over the coming months, roasters of all sizes will need to adapt to find success in a changing market.

“Smaller roasters who have been around a long time can thrive and shift,” Alicia says. “Newer roasters facing costs with smaller customer bases may struggle.”

With global coffee prices expected to remain high, many roasters will need to raise their prices to keep business healthy. However, sharp, sudden increases could risk driving consumers to competitors.

Curating diverse coffee offerings, including blends, at different price points can somewhat mitigate these risks.

“Our blends have always sold the best, demand has just increased,” Alicia says. “We offer seasonal blends that change several times a year.”

Another option is to explore alternative origins that offer competitive pricing.

“For example, in previous years when robusta prices have risen sharply, we’ve seen shifts back to arabica,” John says. “The market adapts based on cost and availability. What’s key is ensuring that any shift in sourcing doesn’t come at the cost of fairness or quality.”

Rising retail prices could result in two outcomes: a shift towards cheaper, white-label products, or growing loyalty to smaller, local roasters.

For many in the specialty coffee industry, the hope is that consumers will support the latter as much as possible.

“Local coffee houses will remain key community hubs,” Alicia concludes. “People need people, and coffee shops have long been places to connect and talk.”

Enjoyed this? Then read our article on the pros and cons of raising your retail prices.

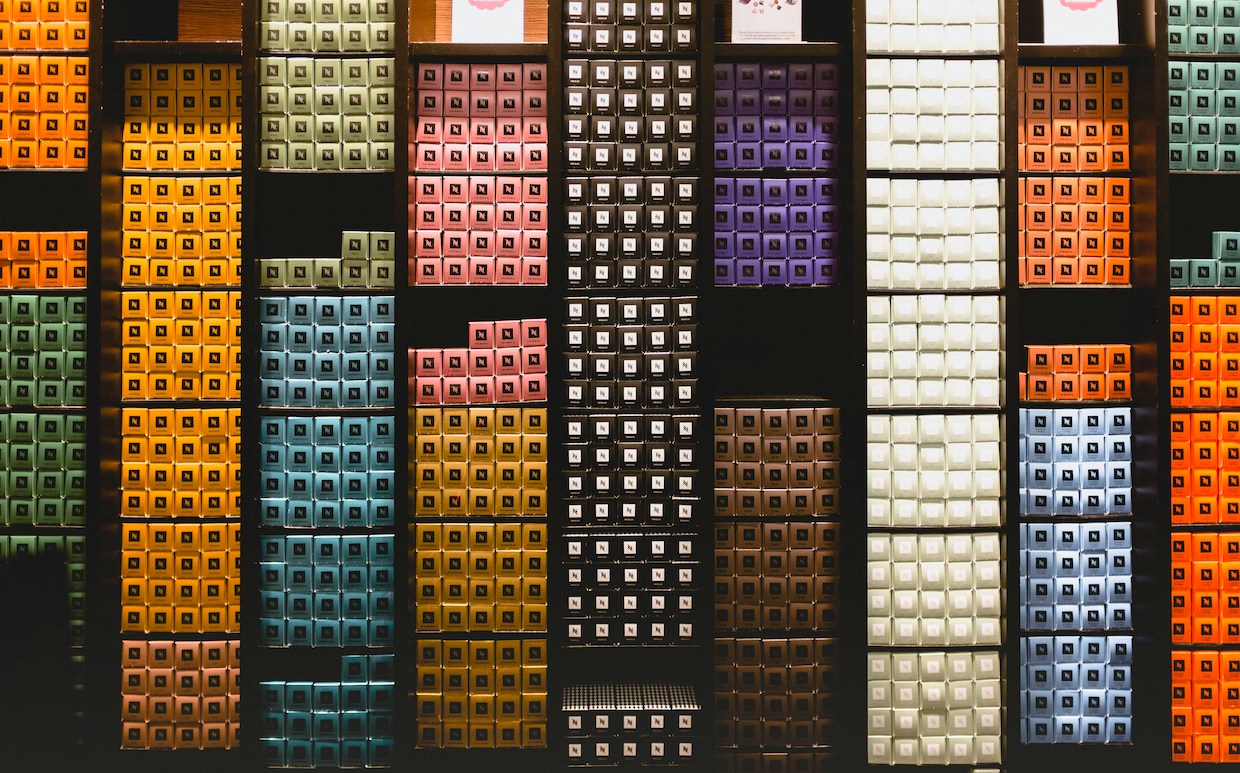

Photo credits: Cafédirect

Perfect Daily Grind

Want to read more articles like this? Sign up for our newsletter!